If you’re in the housing sector, you know the nation’s abuzz with optimism about a real estate recovery. But what about the local, Myrtle Beach market? We’ll get to that in a minute.

In yesterday’s release of the S&P/Case Shiller composite index, David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices stated, “Home prices increased again in July,” and “All 20 cities and both Composites were up on the month for the third time in a row. Even better, 16 of the 20 cities and both Composites rose over the last year.”

And Wall Street is bullish on housing. Last week in Wall Street Daily, Chief Investment Strategist Louis Basenese said, ” The recovery should pick up steam in the coming months.”

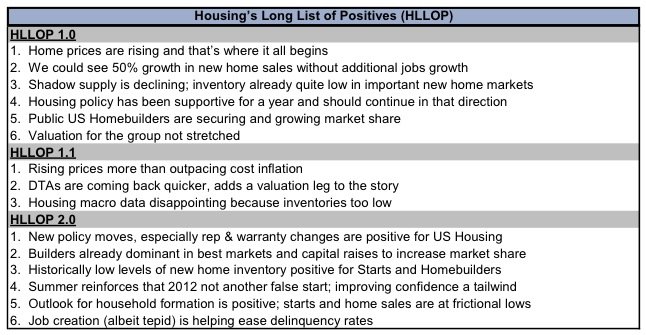

That’s not all. Goldman Sachs released this list of housing’s positives:

Billionaire and Berkshire Hathaway CEO Warren Buffett’s investment advice is to buy houses.

So maybe Warren Buffett wasn’t off-base back in February when he said he’d buy up “a couple hundred thousand” single family homes if it were practical to do so.

Okay, on the national level, everybody’s bullish on houses, but what about Myrtle Beach?

Back on July 8, after the Sun News posted a story about recent price declines in the local market, I countered with documentation showing that five price points had actually increased over the prior year (one by 9%), one remained unchanged, and only two decreased (marginally).

I concluded that the Myrtle Beach real estate market was poised for a rebound, and I received a flood of emails saying I was dead wrong. Dozens of people unsubscribed from my newsletter. And one locally-respected analyst insisted, “We’re still going to see declining prices because of all the foreclosure shadow inventory.”

Now, almost three months later, those same naysayers are changing their tune. That same analyst? She’s now back-stroking, saying how good it is to see recovering prices. And a few days ago, the Sun News shared this positive post: “The median price of homes and condos sold in [in August] jumped 8.3%.” And “The number of homes and condos sold … rose 12.1% … in August.”

Everything’s pointing to upward momentum. For those of you who need proof, I have it. (All data derived from CCAR MLS.)

1. Improving Sales-to-Listings Ratios

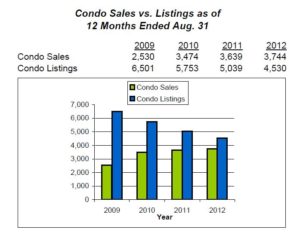

As evidenced by these graphs, every year since 2009, the cavernous gap between available inventory and closed sales has been closing. Today, on average, 84% of listings are sold compared to a pathetic 45% in 2009.

Four Years Ago (year ended August 31, 2009) …

- Out of 6,221 single family listings, there were only 3,221 sales, a sales-to-listing ratio of 52%.

- Out of 6,501 condo listings, there were only 2,530 sales, a sales-to-listing ratio of 39%.

Today (year ended August 31, 2012) …

- Out of 5,495 single family listings, there have been 4,685 sales, a sales-to-listing ratio of 85%.

- Out of 4,530 condo listings, there have been 3,744 sales, a sales-to-listing ratio of 83%.

| ◄ Previous | Page 1 of 2 | Next ► |