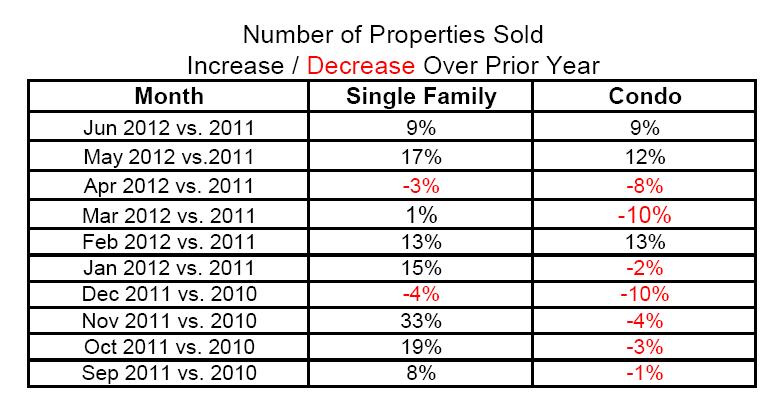

2) Number of Properties Sold: Month-by-Month Comparison

True, it hasn’t been a straight-line progression, but clearly, the numbers do not look bad. In the last two months, sales increased substantially compared to the same month in the prior year. We saw double-digit increases in May. And in June, for both condos and single family, you’re looking at a 9% increase in sales.

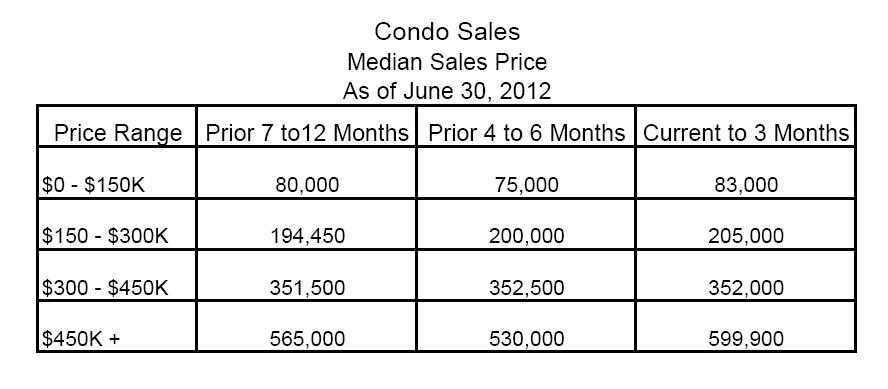

3) Median Sales Prices, 12 Months Ended June 30, 2012

You don’t have to be a statistician to see that overall, prices have been stable to increasing.

Once again pulling from MLS, the only price point that showed a decline is single family homes priced over $450,000. But because that price point covers such a wide range, the generalization skews the results; in this scenario, prices ranged from $451,000 to $3,550,000.

Three days ago, an article in the Sun News reported declining housing inventory; specifically, a 7% drop for single family homes and 11% decrease for condos.

In that article, Realtor/Broker Rod Smith was quoted as saying, “the decline in inventory listings is because there is still a lot of sellers out there not motivated to put their property on the market at today’s prices.” They say, “I don’t have to sell now, I’m going to wait until the market improves.”

I’m sure that’s an accurate assessment; many folks are holding off from putting their property on the market. And whatever the reason for the declining inventory, it’s good for the market, because everyone knows that supply/demand is the primary force behind pricing. With oversupply, prices fall. With scarcity, prices rise.

Clearly, we’re not at the point of scarcity, but statistically, we’ve already reached balanced inventory.

In this post questioning whether Myrtle Beach has hit bottom, we examined five key indicators, one of them being Median Days on Market for properties sold. The data revealed days on market had declined over the last year for both condos and single family from 5.5 months to roughly 4 months.

I don’t have a crystal ball, and it’s true, we have many more foreclosures coming on the market. But judging by historical data, the Myrtle Beach market’s in pretty darn good shape.

July 29, 2012

by Kay Van Hoesen

State Certified Residential Real Estate Appraiser: SC # CR195 • NC # A1042

SC Licensed Real Estate Broker # 29627

| ◄ Previous | Page 2 of 2 |

Sign up for “First to Know” email alerts. Click HERE

_____________________

Every month the trusted experts at Certifax scour the market, analyze and report the best below-market real estate bargains

Most are 10% to 25% below recent prices

Are you a member of The Certifax Report?